US credit gap and systemic crisis

US credit gap and systemic crisis

Abstract

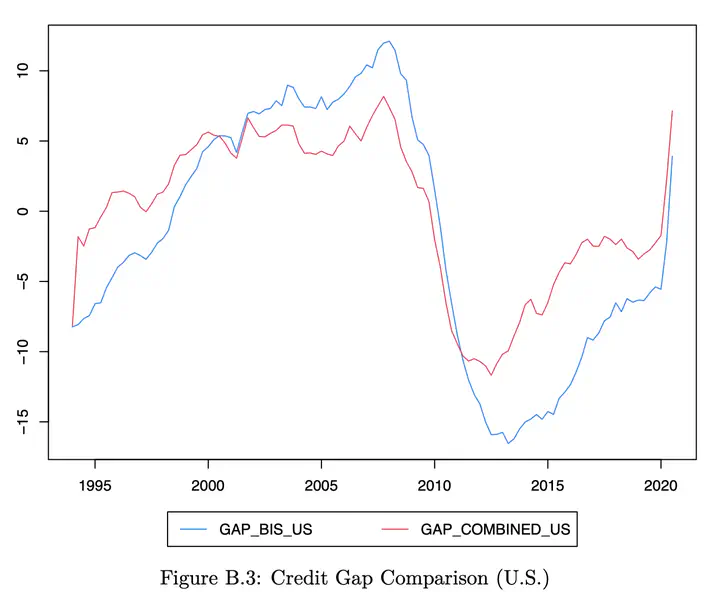

This paper proposes a new method to measure the credit gap - (deviation of credit-to-GDP ratio from its long-run trend) based on its out-of-sample forecast performance. I decompose the total credit-GDP ratio series into short-run deviations and long-run trends using many relevant and popularly practiced methods. I then combine the cycles to construct a singular cyclical series with the highest predictive power on out- of-sample forecasts. The empirical results suggest that by using forecast error weighted average combination, we can produce a measurement of credit gaps that provides superior performance as an early indicator of turning points.

Type

Publication

In University of Wisconsin-Milwaukee