Identifying Unsustainable Credit Gap

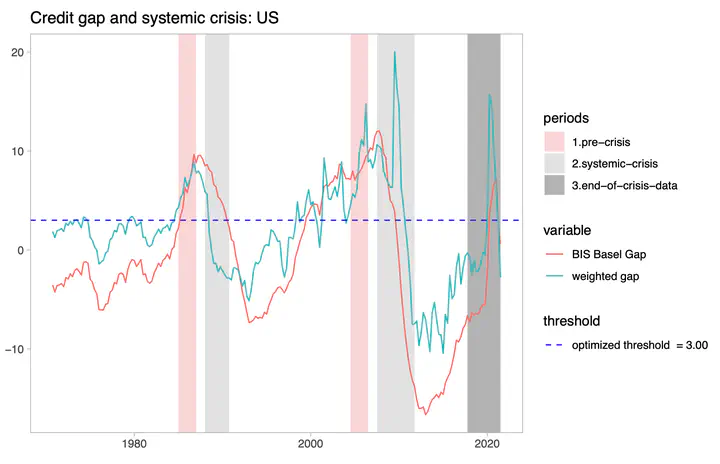

US credit gap and systemic crisis

US credit gap and systemic crisis

Abstract

This paper aims to overcomes model uncertainty in using the credit gap as an early warning indicator (EWI) of systemic financial crises in a binary outcome setting. I propose using model averaging of different credit gap measurements to achieve better averaged model fit and out-of-sample prediction. I also propose a novel, superior criteria to judge the performance of an EWI than the one currently popularly used in the literature. The empirical results showed that the Bayesian averaged model I proposed could synthesize a single credit gap that out-performs any other popularly studied credit gap measurements in terms of an early warning indicator

Type

Publication

In University of Wisconsin-Milwaukee